Mergers & Acquisitions

The goal of Mergers and Acquisitions (M&A) is to achieve rapid growth in a given industry, without having to create another business entity.

QbD supports companies on this pathway.

Challenges and benefits of M&As

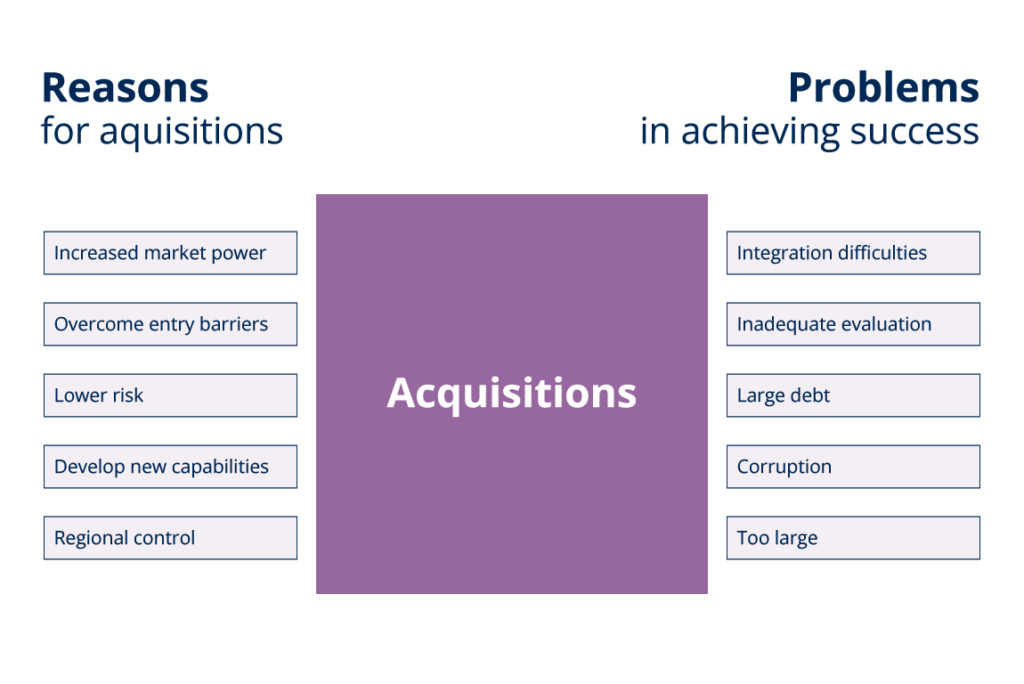

Mergers and acquisitions (M&As) are aspects of corporate strategy, finance and management involving the buying, selling and/or combining of two or more companies. The idea is to achieve rapid growth in a given industry without having to create another business entity1. Here, a distinction must be made between mergers on the one hand and acquisitions on the other.

A merger between two organizations involves a decision by both parties to integrate their operations on an equal basis. An acquisition involves one organization buying a controlling interest in another and clearly establishing itself as the new owner2. The latter scenario can include hostile takeovers.

Both M&As involve considerable financial, market and operational risk.

- Asset valuation

- Historical earnings valuation

- Future maintainable earnings valuation

- Relative valuation (comparable company and comparable transactions)

- Discounted cash flow (DCF) valuation3

- http://en.wikipedia.org/wiki/Mergers_and_acquisitions (accessed 7 July 2008)

- Viney H, Gleadle P. B820 Strategy, “Unit 5, Competitive and Corporate Strategy, session

5 (Corporate Strategy in Multi-Business Organisations),”Milton Keynes, UK: The Open University; 2003:p 87. - S. Michor (2008), Mergers, Acquisitions and Operational Risk, Regulatory Affairs Focus, RAPS.

- Hitt et.al (2003a), Milton Keynes, UK: The Open University.

How we support you

- Carry out due diligence in regulatory, quality and financial aspects

- Help you implement post-merger procedures

- Train you staff on new processes

- Create enthusiasm and participation to further the change implementation process

Why opt for the QbD Group?

⟶ Expert Advice from our team of business consultants

10+ years of experience

Benefit from our team of highly qualified and experienced business experts.

Global presence

QbD operates globally, at QbD Austria with a special focus on Europe (EU) and China.

Eye level communication

Clear and transparent objectives, and constant evaluation.

Contact us

Talk to an expert

Contact us for more information or to request a free, no-obligation proposal.